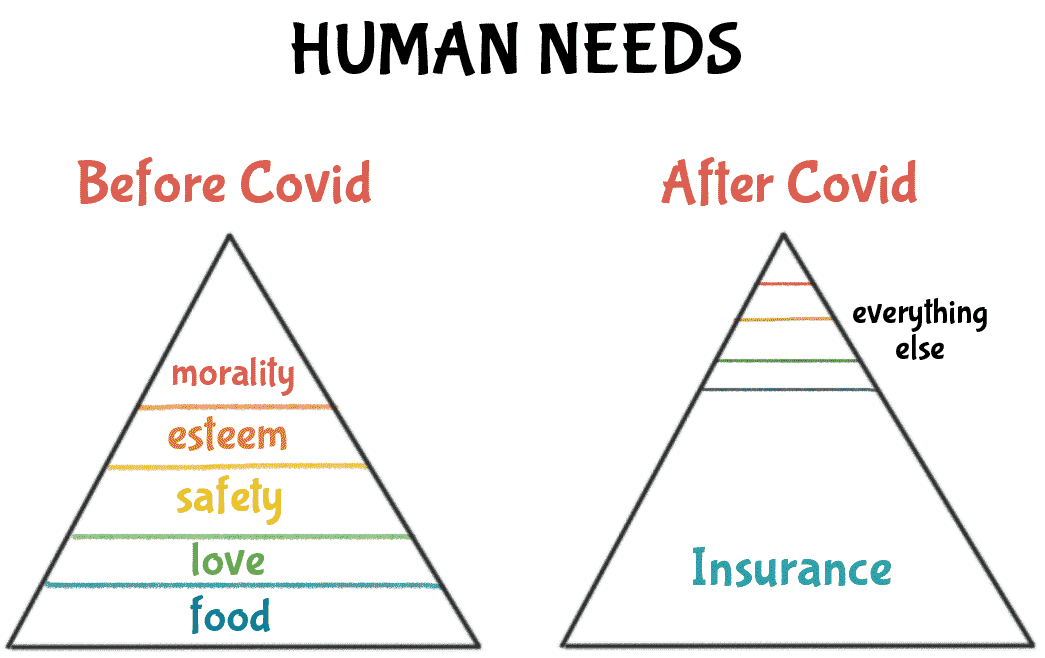

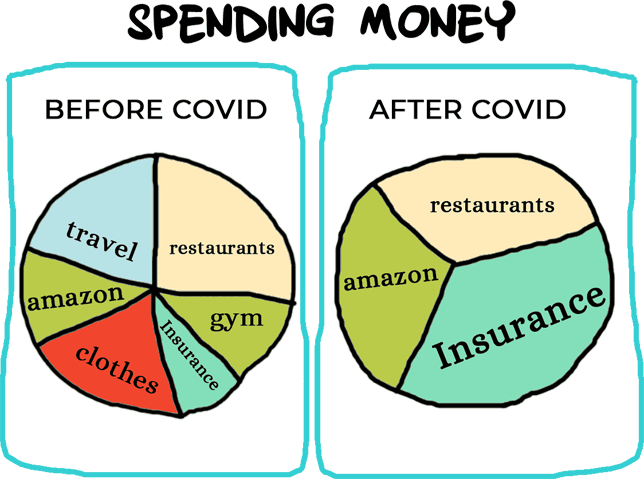

Why exactly are GHI policies unprofitable? One of the most prominent reasons is that health inflation has been surging

at unprecedented rates in the recent past. The median cost of a cataract surgery in India used to hover around 10000

in 2010; in just over a decade, a decent hospital charges you anywhere upwards of 40000 for the same surgery - that is

a CAGR of around 15%; during the same period average salaries have risen by a CAGR of around 9%.

While Compensation & Benefits professionals have started subsuming the rising cost of group mediclaim into the CTC for Employees, a simpler solution could be better underwriting of your GHI policy.

So, what factors affect the premiums of a GHI. here's a list

- Sum insured per employee - this factor has the most proportional bearing on the cost of a GHI - higher the Sum Insured, higher the premium.

- Demography of the group covered - younger the population, lower the premium. A successful GHI is one where the high claim incidence of an aging population is offset by low claims incidence by the younger population.

- Claim ratio of previous year - while a higher Incurred Claims Ratio (ICR) translates into a higher premium at renewal, a continually persistent high ICR could mean you need to relook how your policy has been underwritten.

-

Add-on coverages in the policy/ Corporate Buffer. A simple maternity cover could add anywhere around Rs. 100 to the premium borne per employee. Higher the chances of a claim arising out of an add-on, higher the premium per employee. Customization therefore becomes extremely important.

- A Corporate Buffer can boost employee morale if used appropriately and can get you a discount at renewal when used conservatively.

- Medical inflation in your geography - Increasing medical inflation, improved access to healthcare, and extensive coverage in benefits have pushed claim costs steadily upward. Many insurers have already begun putting limits on claim costs by conducting more investigations, restricting networks, and putting sublimits.

And how do you select your insurer?

- The cost of your group health insurance policy should not be the only criteria for deciding who you should buy the policy from. Another important factor to take into consideration is the claim settlement ratio or the claim paid ratio of the insurer. The claim settlement ratio is the percentage of claims settled by an insurer during a specific period. So if an insurer pays 95 out of the 100 claims received, then its CSR is 95 per cent. The higher the CSR, the higher the probability that the insurer will render efficient services while handling your claims.

Okay, so you have decided on the modalities of the GHI you want to offer, you have even decided on the Insurer,

you think to yourself, that's it, now I pay the premium and insure my employees.

A Broker worth their salt, will get you a breadth of quotes for a breadth of coverages. Are you left wondering how Insurers

could vary their pricing to such extent, for insuring the same set of people for the same Sum Insured?

Well, here's a couple of factors that will help you understand the complexity

With soaring health inflation, a proportionate increase in GHI premiums is more a question of when than will they. Employers need to explore alternative strategies to avoid being caught unaware of the sudden increase in insurance premiums.

With the increased awareness around Health and Health insurance policies, lack of appropriate communication regarding the GHI can be perceived negatively by employees.

Consequently, many Employers keep bearing the cost of increased premium year after year to avoid facing the risk of diminished employee satisfaction.

There is an urgent need to develop long-term measures and metrics which would help in containing costs and ensuring the effective management of health benefits

Companies should consider a flexible benefits strategy and the kind of structure that would be most appropriate in the context of employee satisfaction, expense control, and revenue growth.

Ethika has developed many tools and strategies that can help an employer overhaul their employee benefit program and align it with future needs.

Get a free review of your

Get a free review of your

Raafi Mohammed

Raafi Mohammed

PavanKumar Joshi

PavanKumar Joshi

Sai Kosuri

Sai Kosuri  Kamesh Mantri

Kamesh Mantri

Mandeep pasbola

Mandeep pasbola

Kiranashree M S

Kiranashree M S