While we give the best perks and benefits to our directors and CEOs, we ignore the basic benefits for our workers. They are the only breadwinners in the family. In addition to taking care of occupational safety, one should always value their well-being.

We would rather call it Work-care compensation insurance? In this article, we will look at what workmen’s compensation is, what types of workmen’s compensation insurance are, and what its benefits are.

What’s on this page?

What is Workers’ Compensation Insurance?

In simple terms, Workers’ compensation provides medical expenses and rehabilitation costs to a certain class of employees who are injured in the course and scope of their job

Employees who suffer a medical or monetary loss during the course of their employment, such as an injury, accident, or even death, can receive benefits from it.

It serves two purposes:

- It ensures that the injured worker gets medical care and compensation for lost income until they are able to return to work.

- It also protects the company from any lawsuits resulting from the injury.

The compensation and benefits vary a little from state to state.

It is likely you are wondering what benefits you will receive if you qualify for this insurance.

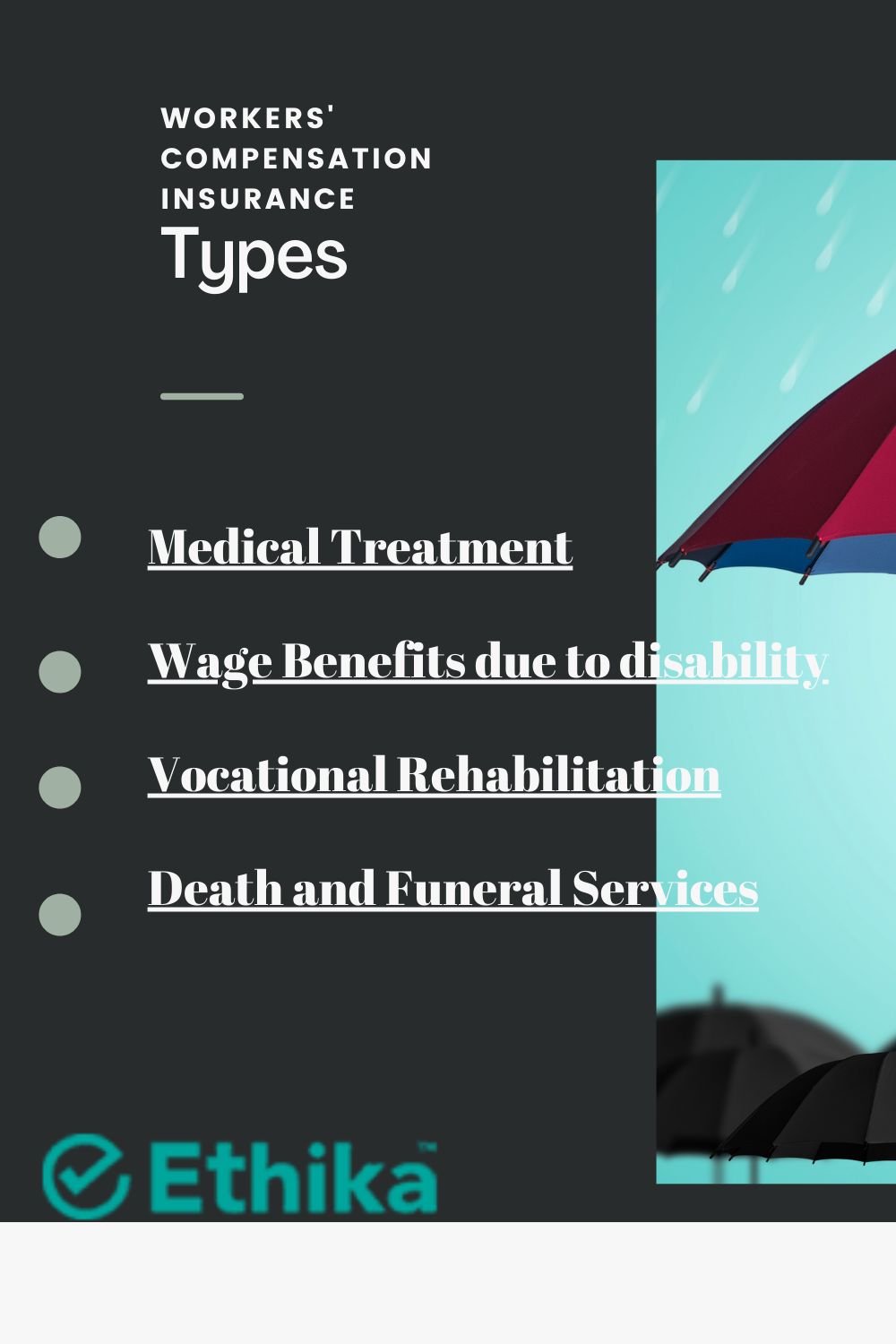

The workers’ compensation classifications will assist you with this information:

Type 1

Medical Treatment:

If your employees witness any injury or illness at work, then the insurance provider and employer are responsible for paying the medical expenses. So under this category, medical benefits include:

- Doctors appointment fees

- Hospital and emergency room visits

- Medication cost

- Rehabilitation and therapy charges

- Cost of recovery equipment

- Cost of surgery, if required

It takes time for some severe injuries to recover. Such ongoing costs will also be taken care of by workers’ compensation.

However, below alternative care treatments are not covered:

- Homeopathy treatment

- Naturopathy treatment

- Acupuncture

Type 2

Wage Benefits Due to Disability:

Sometimes an injury or accident at the workplace leaves an employee disabled and affects his/her ability to work. It compensates you for the wages you lose due to your injury making it impossible for you to work.

A disability can be classified into one of the following four types:

- Temporary Total disability: The benefits of such disability are extended to workers who cannot work at all, but for a certain period of time. They will, however, be able to return to work in the future at full capacity.

- Temporary Partial Disability: This is a type of disability benefit offered to workers returning to work after being injured but at a reduced level of capability. Workers may be able to work at a slower pace or for only certain hours during the day.

- Permanent Total Disability or Total Disability Benefits: The damage here is so extensive that a person cannot return to work. Their disability prevented them from earning a steady income.

- Permanent Partial Disability: Here the worker can resume work, but will never be able to work in the same capacity. There is permanent damage in the body that partially impairs the ability to work.

Type 3

Vocational Rehabilitation:

In the aftermath of an injury or illness, workers may need assistance returning to their previous jobs. The assistance may need to cover the costs of medical and therapeutic care, such as physical therapy or counseling.

Other than this, sometimes the injury prevents you from returning to your; former job. Under this scenario, a disabled worker may also receive a transferable skills analysis. In this way, they can learn new skills and get acquainted with new types of work that suit their needs, and find other roles to fit their needs.

Type 4

Death and Funeral Services:

An unfortunate event may result in a worker’s death due to an injury or illness at work. This type of compensation policy covers the expenses for funerals and lost income. The benefits are extended to their family and beneficiaries. Usually, these plans have a limit to the expenses, which may vary from state to state. Most states calculate this benefit as a percentage of the deceased worker’s earnings

The benefits are offered to living dependents or immediate family members:

- Spouse

- Children

- Parents

To sum up, select the right compensation policy for your workers as different insurers will provide policies with different injuries and coverages.

Also, the workers’ compensation policy premium depends on a number of factors such as:

- Number of workers

- Nature of industry

- Wage of workers

- Classification of industry

- Safety standards

- Risk location

- Previous claim experience

Other than that, if you are looking for employee health insurance – must read the benefits of group health insurance.

A policy like this not only makes your company financially prepared for any unfortunate events but also makes your workers emotionally stronger. They would always feel secure about their job and family.

For any assistance related to the policy, you can always take guidance from your trusted insurance broker.