Tag: Insurance Broking

Karnataka Government Strengthens Employee Benefits: Compulsory Gratuity Insurance Rules Take Effect

The Government of Karnataka has enacted a landmark legislation that significantly benefits employees across the state. The Karnataka Compulsory Gratuity Insurance Rules, 2024, introduce a mandatory insurance requirement for employers to secure their gratuity obligations. Let’s break down what this means for employers, employees, and insurance brokers within the state. Understanding Gratuity Gratuity is a […]

Read More

Bima Sugam: Revolutionizing Insurance in India

India’s insurance landscape is undergoing a significant transformation, and at the heart of this change lies Bima Sugam, an ambitious initiative promising to simplify and democratize access to insurance for all. Let’s delve into this game-changer, exploring its essence, evolution, and potential impact. What is Bima Sugam? Bima Sugam, translating to “easy insurance” in Hindi, […]

Read More

All About Liability Insurance

Liability insurance is a type of insurance coverage that protects businesses and individuals against third-party claims of negligence, errors, or omissions that result in bodily injury or property damage. Let’s explore liability insurance, why it’s important, and how Ethika Insurance Broking can help you get the right coverage. What is Liability Insurance? At its core, […]

Read More

How to Choose the Right Insurance Broker?

Insurance brokers play a key role, sourcing policies and assisting with claims. Experience, capabilities, relationships, response times, and recommendations all factor into choosing the right broker.

Read More

What is a Material Fact in an Insurance Contract?

In the complex landscape of insurance contracts, grasping the significance of material facts is crucial. As a policyholder with Ethika Insurance Broking, comprehending these facts is pivotal for making informed decisions about coverage. The Crucible of Clarity: Material Facts in Insurance Contracts Unraveled Defining Material Facts Material facts are key information influencing an insurer’s decision […]

Read More

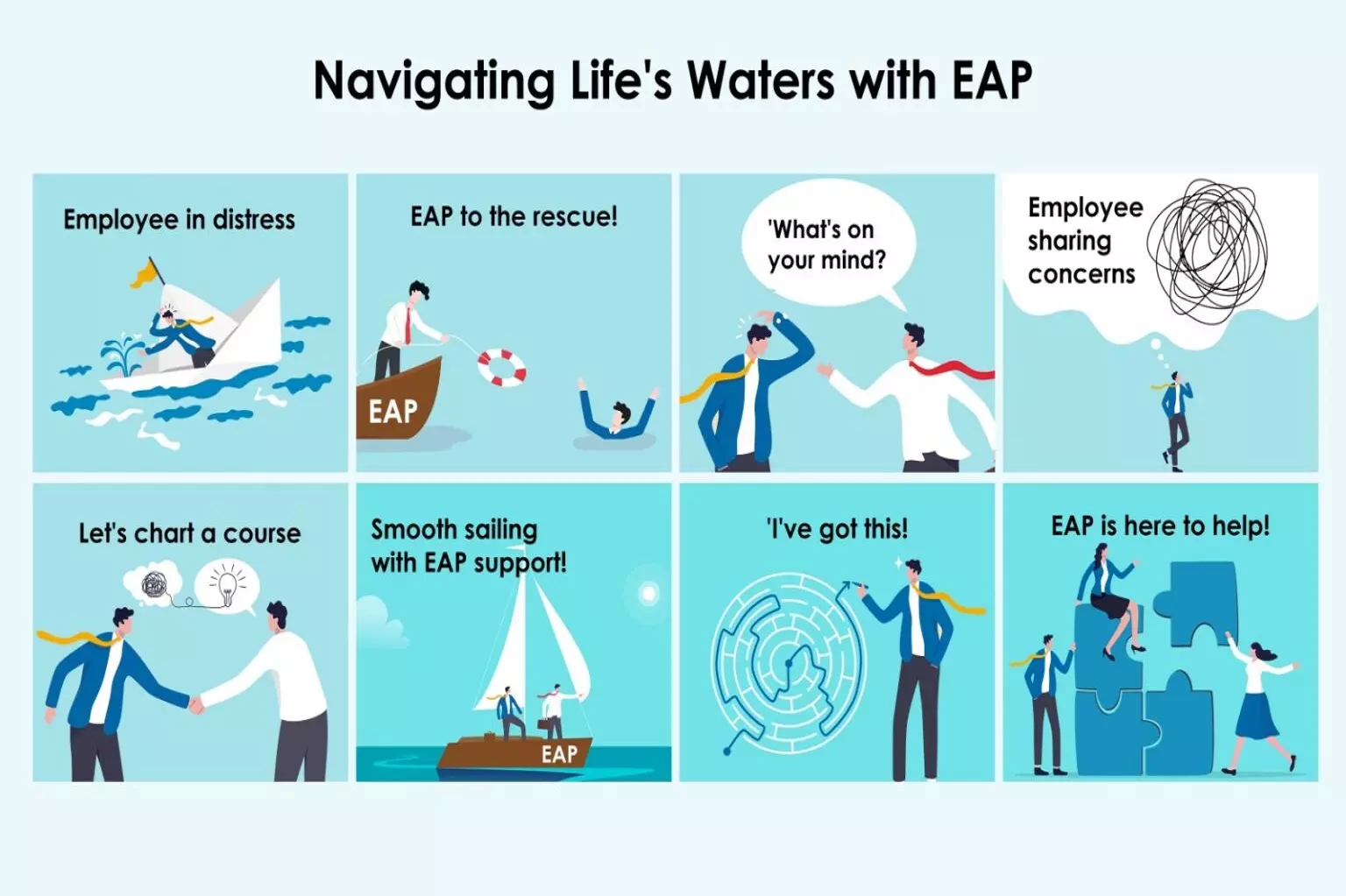

Navigating Life’s Waters with EAP: What Can You Share?

Navigating life’s unpredictable journey presents challenges ranging from stormy weather to sunlit horizons. Employee Assistance Programs (EAPs), like those offered by Ethika Insurance Broking, act as reliable lifebuoys, providing a secure harbor for individuals to address a myriad of concerns openly. The Significance of EAPs in Addressing Various Facets of Our Lives Are:- 1. Stress […]

Read More

Rethinking Global Mandates in Insurance Broking: A Case for Local Expertise

In the dynamic realm of insurance broking, a noteworthy trend is emerging—the prevalence of global mandates. These agreements, forged between clients and brokers, commit clients to exclusively availing services from a designated broker globally. While such arrangements often rely on international relationships between brokers and their clients’ head office personnel, a critical question arises: Can […]

Read More

Indian Finance Budget 2023 – Impact on Insurance Sector

The Indian Finance Budget 2023 has brought about significant changes poised to shape the landscape of various sectors in the country. One such sector that has garnered attention is the insurance sector. In this article, we will delve into the implications of the budget on the insurance sector, focusing on Ethika Insurance Broking, the impact […]

Read More