Author: Susheel Agarwal

How to Pickup an Affordable Group Health Plan for your Startup?

It’s an acknowledged fact that hiring for a start-up is a challenge that every entrepreneur’s (especially first-time ones’) headache is centered around. Attracting a settled and performing individual to leave all behind and jump ship (more like jump ship to the boat) is hard enough. Fortunately, there are means and instruments, such as group health […]

Read More

Directors & Officers Liability Insurance

ABOUT PRODUCT IN BRIEF: Being a Director or Officer of a company brings with it not only the stresses and strains of making business decisions, but it also exposes the individual to enormous potential personal liability. This in turn is leading to greater concern among Directors & Officers of Indian Corporates. D & O […]

Read More

All About Liability Insurance

Liability insurance is a type of insurance coverage that protects businesses and individuals against third-party claims of negligence, errors, or omissions that result in bodily injury or property damage. Let’s explore liability insurance, why it’s important, and how Ethika Insurance Broking can help you get the right coverage. What is Liability Insurance? At its core, […]

Read More

What is the Difference Between Employee Compensation and Employee Benefits?

Compensation vs Benefits Compensation refers to the monetary consideration an employer provides employees in return for their work and contributions to the organization. The pre-agreed-upon remuneration forms part of an employee’s total cost to the company (CTC). Forms of Compensation Employee compensation generally includes the basic pay or salary. However, it may also encompass various […]

Read More

How to Negotiate for Billing While in Hospitalization Without Insurance

The commercialisation of health care is a burning agenda today. There is no regulation on hospitals and hence we don’t have anything like MRP or say standard rates for hospital procedures. Negotiating with the art of negotiation under the assumption that there is no medical insurance.

Read More

Importance of Declaring Claims Details in Motor Insurance

We all buy motor insurance to have financial protection in case our vehicle is damaged in an accident. However, making a claim can often lead to higher renewal premiums with our insurer. This is why some people are tempted to hide past claims from their insurance company when renewing their policy. But as we’ll explore […]

Read More

What is a Material Fact in an Insurance Contract?

In the complex landscape of insurance contracts, grasping the significance of material facts is crucial. As a policyholder with Ethika Insurance Broking, comprehending these facts is pivotal for making informed decisions about coverage. The Crucible of Clarity: Material Facts in Insurance Contracts Unraveled Defining Material Facts Material facts are key information influencing an insurer’s decision […]

Read More

Your Guide to Voluntary Top-Up in Group Health Insurance

The group health insurance voluntary top-up option is one such way in which insurance companies provide flexibility in their group plans. Earlier, group plans used to be highly rigid and one-size-fits. However, these days, insurance plans have become much more sophisticated and better at solving the needs of users.

Read More

Is Group Health Insurance Becoming More Affordable and Accessible?

Group health insurance is slowly becoming a necessity for most companies, regardless of size. The rising cost of healthcare makes it even more important. Every company needs to look after its employees, and purchasing group health insurance is more cost-effective than asking employees to avail of their own individual health plans. The good news is […]

Read More

IRDA Proposes Motor Cover for 3 years for Cars and 5 years for 2 Wheelers

The Indian Insurance Regulatory and Development Authority (IRDA) has asked for the withdrawal of long term comprehensive package cover for two wheelers and private cars. This was based out of concerns arising out of policyholder sentiment of being stuck with Insurers, despite deficient service.

Read More

Things to Consider While Buying Group Health Insurance for an IT Services Company

Different types of companies have different needs from their group health insurance provider. As an IT services company, it can be confusing to find the right insurance product that meets all your needs. This can be especially difficult since there are so many insurance products to choose from. However, with the right guidance, the process […]

Read More

Personal Health Insurance Glossary

Insurance involves a lot of technical terms that a layperson may not be aware of. However, it is important to be familiar with these terms as it helps you to understand the terms and conditions of a health insurance policy. Further, it helps to choose the right insurance policy for your needs. We’ve covered some […]

Read More

How are Group Health Insurance Premiums Calculated in India?

The higher the risk associated with an insurance policy, the higher the premium that the insurance company will charge. For example, the premium of health insurance for a twenty-year-old will be much less than the health insurance premium for a sixty-year-old. This is because the chances of a twenty-year-old contracting a serious illness are much […]

Read More

5 Reasons to Offer Group Health Insurance to Your Employees

Group health insurance refers to health insurance that can be availed by a company for its employees. Group health insurance plans can have several advantages over personal health insurance plans. Further, providing group health insurance to employees can also benefit a company in a variety of ways. Nowadays, almost every company is getting on the […]

Read More

Things to Consider While Buying Group Health Insurance for a Construction Company

Every type of company has its own requirements when it comes to health insurance. Some companies are relatively high risk when compared to other companies. A high-risk company is a company whose employees operate under less safe working conditions when compared to other companies. A construction company is considered to be relatively high-risk because accidents […]

Read More

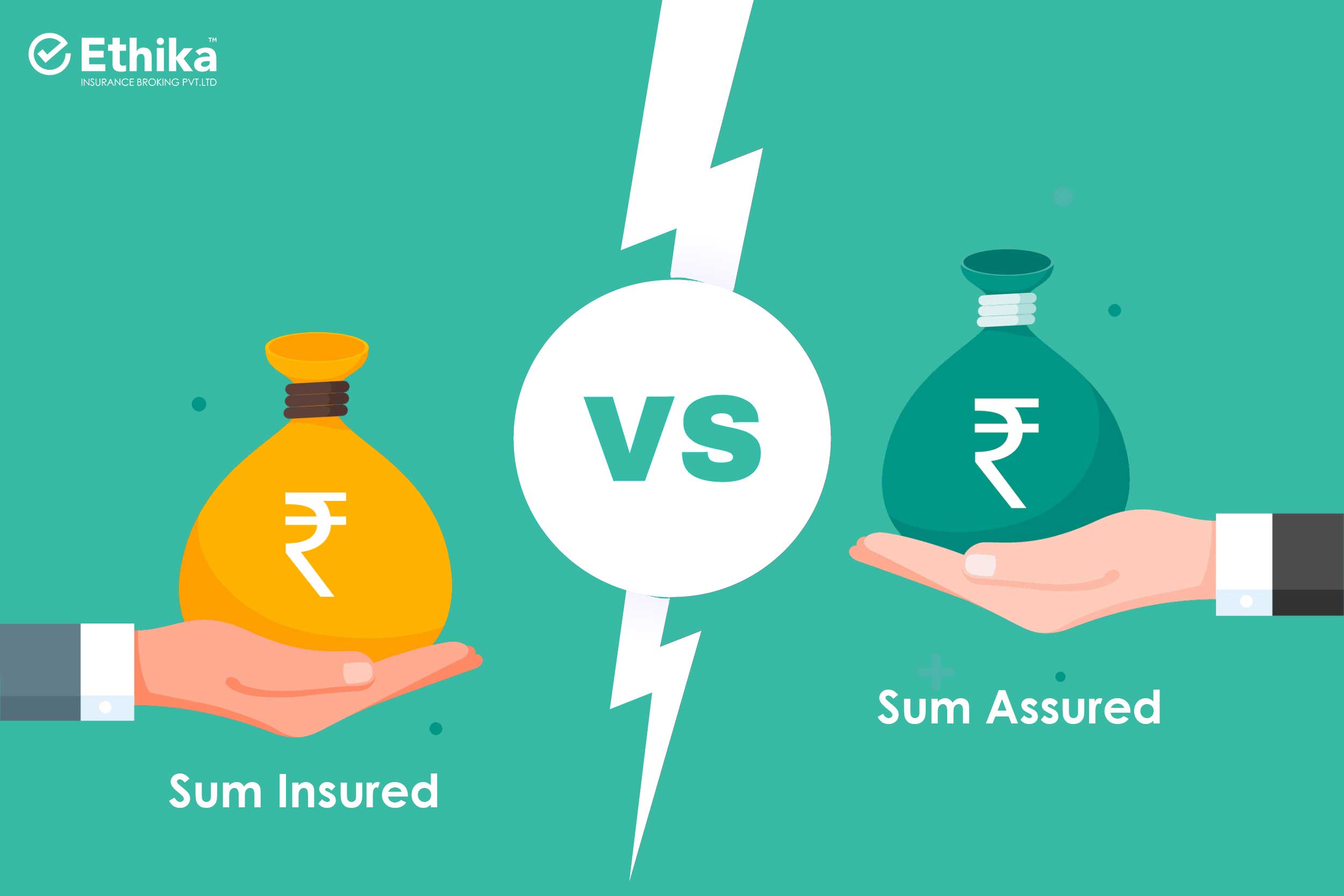

Sum Insured vs. Sum Assured in Group Health Insurance

Before you choose a group health insurance for your company, it is important to research the difference between insurance policies. Insurance policy documents contain several technical terms that a policyholder needs to understand. Two commonly used terms are “sum insured” and “sum assured”. Understanding what the two are and the difference between sum insurance and […]

Read More

What is Corporate Buffer in Group Health Insurance?

A group health insurance policy can be availed by companies for their employees. It is one of the most common benefits offered by corporates to their staff. Availing of a group policy has several benefits and advantages which are not available in an individual or family policy. The corporate buffer is one such benefit. In […]

Read More

How to Add or Delete Employees in Group Health Insurance?

Group health insurance is usually provided by companies as a benefit of employment to employees. Depending on the company, the employees may pay a discounted rate for their insurance or get health insurance completely free of cost from their employer. After opting for group health insurance, companies and employers can have several questions about how […]

Read More

What is Capping or Sub-Limit in a Group Health Insurance Policy?

Before opting for a group health insurance policy, employers need to be aware of and familiar with the terms and conditions of the policy. There are several details in a policy which may seem minor but can have far-reaching consequences. It is better to go through the policy document carefully so that there are no […]

Read More

What are the Types of Endorsement Scales in Group Health Insurance?

An insurance policy is not set in stone. There are several circumstances in which the terms and conditions of an insurance policy may need to be changed. Some of the reasons may include a change in the relationship between the proposer and the insured, a change in the details of the nominee, an addition or […]

Read More

Top Reasons Why Employees Don’t Use Group Health Insurance

As an employer, you may be considering offering a group health insurance to your employees as a benefit. Why is group health insurance important? There are several advantages of offering group health insurance such as better employee retention, higher goodwill in the market, improved productivity of employees, and so on. A group health insurance is […]

Read More

Top 20 Reasons You Must Invest in Group Health Insurance for Small Businesses

If you’re a company, start-up, small business, or large organization of any kind, it is important to consider opting for group health insurance. A group health insurance, as the name suggests, is a health insurance policy that covers several people together. Hence, the entire staff or members of an organization can be covered within a […]

Read More

Organ Transplants and Health Insurance

The past few centuries have witnessed great strides in medical science with revolutionary medical breakthroughs. Be it the invention of vaccines and antibiotics or the more recent developments in artificial intelligence, advancements in the field of medicine have not only increased life expectancy but also helped improve the overall quality of human life. Organ transplantation […]

Read More

Which one is better to opt – Retail Health Insurance or Group Mediclaim

Look at the this comparison that will help you understand the difference between group and retail health insurance.

Read More

Get Fire Insurance Policy Premium Rates for your Home

If I ask you how many of you have a Fire Insurance policy for your home? Chances are unless it was enforced upon you by the bank you got your loan from, 90% of you might say you don’t have one. Let’s understand the fire insurance premium rates for your home with the following example: […]

Read More

The Right Term in a Term Insurance Plan.

Yesterday I overheard a conversation between two friends, here’s a transcript of how it went – Amit : Hey Suman, I turn 30 next month, what do you think should I gift myself? Suman : Haha, finally you go to the wrong side of youth, very soon you will be the disadvantageous demographic dividend 😄 […]

Read More

Are Legal heir and Nominee the same?

Sheena is late for the meeting with her lawyer Imran. Imran had sounded anxious over the phone, she recalls. When she finally reaches Imran’s office, Imran’s secretary hands her a judgment that Imran has asked her to. As she reads it, her eyes well up in grief and she cannot help but tumble in the […]

Read More

How Technology is Changing Group Health Insurance?

Do you still use telegrams when you need to deliver urgent messages? Do you use a bullock-cart pool to work? When was the last time you plugged in a cassette or backed up your laptop on floppy discs? Better still, how about a dial-up connection for all your internet needs? No no don’t worry I […]

Read More

Types of Workers’ Compensation Insurance

While we give the best perks and benefits to our directors and CEOs, we ignore the basic benefits for our workers. They are the only breadwinners in the family. In addition to taking care of occupational safety, one should always value their well-being. We would rather call it Work-care compensation insurance? In this article, we […]

Read More

The Next Big Thing in Group Health Insurance for Startups

Before we talk about Group Health Insurance for startups, let’s talk about existing times. This is both one of the best and, ironically, one of the worst times to be alive. Wealth and health are faltering and building up at alarming paces, uncertainty is widespread. But you know what else is widespread – the spirit […]

Read More

Advantages You Should Know About Commercial Fire Insurance Policy

An enterprise, big or small, is the culmination of years of effort and a lifetime of investment. Our business is protected from any evil eye by all means before it is set up, especially in India. However, is our business prepared for disasters? Has it been protected against fire damage? What are the commercial fire […]

Read More

The Biggest Problem with Group Health Insurance- Advantages and Disadvantages, and How You Can Fix It?

If you are looking for a group health insurance plan, we hope you have read our guide to the pros and cons of different types of health insurance plans available on the market today at Health Insurance Company (HIC).

Read More

Steps to Get the Fire Insurance Claim

We buy fire insurance to protect our property. The property may be residential or commercial, owned or rented. Insurance not only provides protection against natural or man-made disasters but also assures policyholders that in the event of any unfortunate event, the insurance company is there to assist in any way. In order to ensure a […]

Read More

11 Reasons Why You Should Invest in Group Health Insurance

Have you ever noticed how inadvertently the word ‘Group’ and all its applied implications, connotations, make such a huge part of our lives? No matter how you look at things whether you identify as an individualist or a conformist. We are all at the end of the day a part of something or the other […]

Read More

How to structure the right employee benefits package?

With employment opportunities galore and an open war for talent, employers are trying to find innovative ways to win over the 60% of the population that is under the age of 25. Indian companies historically have provided employee benefits such as health coverage, leave benefits and statutory retirement programmes. These were fairly standard in old […]

Read More

How to Pick an Affordable Group Health Plan for Your Start-up?

The importance of a health insurance plan is not unknown. As a start-up owner, one of the biggest questions you might be tackling is whether or not you should offer health insurance cover to your employees. A group health insurance plan, is a health insurance coverage offered to people working in the same organization. This […]

Read More

Personal Health Insurance: How to make it Affordable?

The personal health insurance premium is the amount paid by a policyholder to the health insurance provider. Other charges, such as deductibles and co-payments, can increase the cost of your overall health coverage premium.

Read More

6 Steps to Reduce Group Health Insurance Premium Cost

Cost-cutting is a hard reality, especially in the post-pandemic era. As an employer, you want to do what is best for your employees while not losing sight of your company’s long-term goals. For your company to run smoothly and have a sustainable future, you must look at all possible ways to reduce your costs. Your […]

Read More

Mobile Phone Insurance : Is it just enough?

Who is the one person that knows you more than you know yourself? The answer is not a living being but an inanimate object – your smartphone. From your thoughts to your eating preferences and your political opinions, your smartphone is your personality condensed into digital data. With all the sensitive information such as your […]

Read More

Coronavirus- The high impact on employee mental health

It’s no surprise that the Indian economy has taken a big hit post corona as the news arrives. The GDP of the country has contracted in double-digits, the lowest in decades. We have come from being the world’s fastest-growing economy to our GDP being lower than Bangladesh, the situation looks bleak for everyone in 2020. […]

Read More

MOTOR INSURANCE (Private Car) – Things you Should Know

A mechanically self-propelled vehicle; supposed to be ply on the public roads should have at least ‘ THIRD-PARTY ‘ Insurance as per the Motor Vehicles Act Coverage under motor insurance: OWN DAMAGE: (Comprehensive) The company will indemnify the insured against loss or damage to the insured vehicle. i. by Fire ii. by Explosion iii. by […]

Read More

Let us divorce– first hand story

“This will put an end to all your problems,” he said sternly and left. I sank into the sofa, stunned. Dumbfounded. What did I do for this? Don’t I deserve a good life, a happy relationship and a secure future? Don’t I deserve joy or some peace of mind at the very least? Am I […]

Read More

Gift Your Spouse “Health Insurance” this Karwachauth

I walked into my bedroom, after my dinner and a stroll. It is already past 8 PM. My wife, Sharada (Saru, as I lovingly call her) also would have retired by now. As I entered, I saw my Saru standing at the fully open French window, gazing at the moon, with wide-open arms, as if […]

Read More

How Should Start-ups get Group Health Insurance?

This is the most frequently asked question by startup founders. Though it is not mandatory to offer Group Health Insurance to the Employees for white-collar Employees, the organizations provide this as a benefit to the Employees as every other organization is doing so. Employees expect to get Health Insurance benefits from the Employer, as it […]

Read More

Why is Health Insurance Important?

The pandemic has made the world realize that medical emergencies are unpredictable and can cause a financial catastrophe so huge that it would be impossible to bear the burden without the aid of insurance. Treatment in a private hospital can derail your finances, and it becomes more difficult if the breadwinner of the home suffers […]

Read More

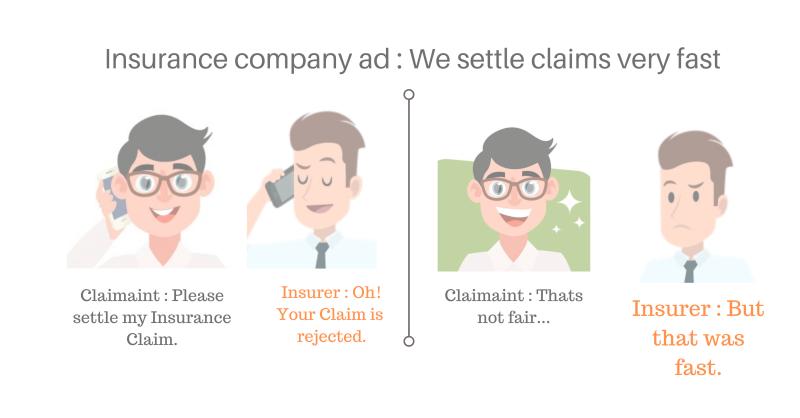

Health Insurance Claims – A Perspective

Health is Wealth. This is a saying which every one of us will agree and vouch for. However, it an unwelcome situation where the hard-earned wealth has to be spent to regain the health which got deteriorated for some reason or the other. It is from this concept that the ideology of Health insurance cropped […]

Read More

What are the Tips to Choose the Best Health Insurance?

Choosing a well-suited health insurance policy from the many options available in the market could feel like a herculean task. You need to take into consideration many factors before making a purchase. But with so many confusing details, it is easy to get bogged down, and you may make a hasty decision and end up […]

Read More

How does Group Health Insurance Work?

A Group Health Insurance policy is a single umbrella policy that is offered to Companies and covers the health insurance needs of their employees. Most often this policy is offered as a benefit to the Employees by the Employer. The policy can be extended to the Employees’ Spouses, Dependent children & Dependent Parents / In-laws […]

Read More

How a super top-up health insurance plan can help you?

How a super top-up health insurance plan can help you? The only cost-effective way to protect against the current medical inflation and meet medical requirements is to have a Super top-up Health insurance policy. Serious medical emergencies can ruin our finances at any time, this can be only avoided with adequate insurance cover for our […]

Read More

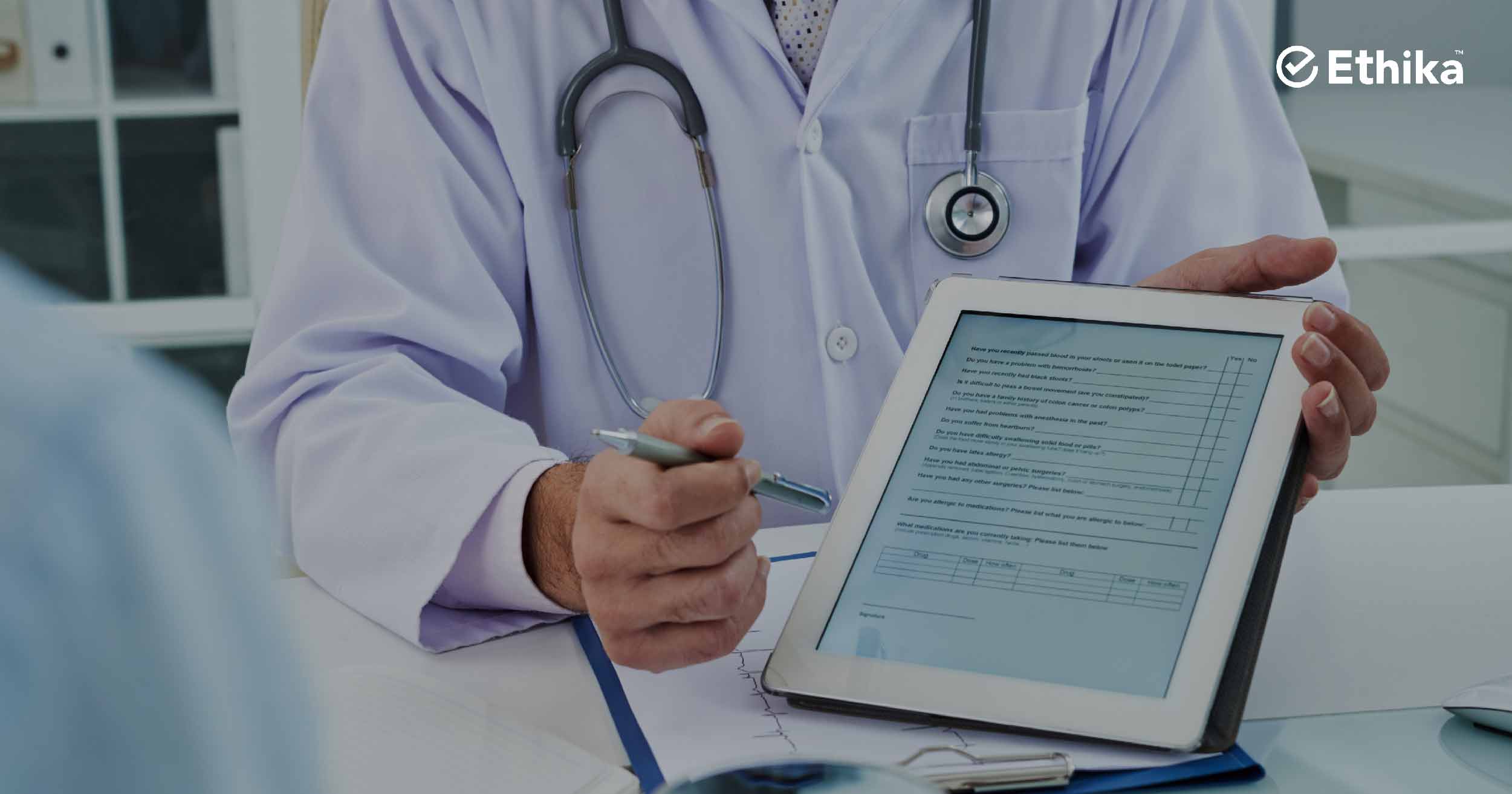

Have you Noticed this Condition in your Health Insurance Policy?

All you need to know about pre-existing diseases in Health Insurance. Pre-existing diseases are diseases that the policyholder already suffers from before purchasing a personal health insurance policy. This policy condition determines playability in a majority of health insurance claims. Must Read – What are the Benefits of Super Top Up Health Insurance Plan? As per […]

Read More

Death claim in Insurance – Execute A Will For Your Nominee To Get The Proceeds Of Your Insurance Claim After Your Death

Like thousands of people, do you think that the Nominee will get the proceeds of your Insurance Claim after your death? Then you are mistaken. The nominee is just a custodian of the claim amount. He can’t spend the amount. He will have to give the proceeds to the legal heir as per the succession […]

Read More

Group Mediclaim to Personal Health Insurance Portability

The insurance regulator has permitted the porting of health insurance. Here are the guidelines for converting group health insurance to individual health insurance: If an employee wants to port the policy to a personal health insurance policy from the group policy, he can do so, at the time of exit from the company. The employee […]

Read More

How to use Section80D to save maximum tax?

We are allowed to claim a deduction of Rs.25K from our taxable salary for the Mediclaim Insurance premium. But so many of you will be covering yourself (including spouse and kids) within Rs.10K to 15K only. You can utilize the balance benefit by purchasing an Outpatient benefit Insurance policy. For example, let’s say your Mediclaim […]

Read More

3 options for the high Treatment cost of Covid

Worried about the high Treatment cost of COVID? Here are the 3 options you have Option A: Ask for an additional Corporate Floater from the Same Insurer Any claim crossing the normal sum insured can be paid from this corporate Floater. You should have a minimum of 40 lacs buffer, for a group size of […]

Read More

Why Insurance claims of accidental deaths caused by drunk and drive are denied?

I was having an interesting chat with one of the corporate hr leaders yesterday. His question was: “Why in Accidental Deaths, if the person died is found drunken driving, he is denied the insurance claim ” He continued “the proceeds of the claim are meant for his family members. Why punish family members for the mistake […]

Read More

Ethika Insurance Broking awarded in the ICICI Udaan event as the top emerging Broker

Ethika Insurance Broking awarded in the ICICI Udaan event as the top emerging insurance broker. We like to thank ICICILombard for acknowledging us. Our focus on the happiness of our clients, employees and our partner drives us to success.

Read More

Modern Treatment methods and your Health Insurance

With rapid advancements in the field of medicine, every year, we see many new and modern methods of treatment being made available for the benefit of the people. Listed below are a few such Modern Treatment Methods: A. Uterine Artery Embolization and HIFU B. Balloon Sinuplasty C. Deep Brain stimulation D. Oral chemotherapy E. Immunotherapy- […]

Read More

Does Covid 19 gets covered under Workmen compensation Insurance policy?

If you are already covering your workers under ESI then the workmen compensation policy is not applicable. The compensation and treatment cost of the disease will be as per ESI policy. For those cases where the workers are only covered under the Workmen compensation policy, you can read further. Workmen’s Compensation policy covers any worker […]

Read More

Insurance Broker Vs Insurance Agent

I was traveling to Vizag by train. During journey the person beside me seemed very knowledgeable. We immediately became friends. During our conversation, he asked me, what I do for a living. I said, “I am an insurance broker”. His attitude toward me immediately changed. He hardly spoke to me later. “What happened ?”, I […]

Read More

20 Lakhs Health Insurance At Just 2k For Your Family

20 Lakhs Health Insurance At Just 2k For Your Family Recommended Post Best Health Insurance Policy in India

Read More

Covid-19 Health Insurance Policies Comparison

Insurer Eligibility Age No Travel Benefit Type Sum Insured Premium (Rs) Other Benefits Digit Group Policy (with Flipkart) 18-60 Yrs Last 30 days Indemnity 3L & 1L 1267 511 1. 30& 60 Days pre & post Hospitalization 2. No room rent capping 3. Ambulance Assistance 1% ICICI (with PhonePe & Flipkart) 18-75 Yrs After 31st Dec […]

Read More

“your insurance policy does not cover this” don’t here this ever from insurer

Customer – I want to claim my laptop theft. Insurer Claim Manager -Oh I am so sorry? How did you lose it? Customer – I actually lost my car key in during parking and someone stole the laptop from my car. Claim manager – Oh I am so sorry. It is not covered as it […]

Read More

Health Insurance for Workers is made Mandatory by Government

In the guidelines released by the Ministry of Home Affairs, it has been made mandatory to have health insurance for workers when the restarting of operations starts on April 20th. Normally, in a factory or manufacturing premises, the workers are covered under Workmen’s Compensation for occupational hazards and not for medical insurance. Some workers covered […]

Read More

How to be prepared to have hassle free treatment & claims process in personal health insurance

An insured purchases a personal health insurance policy after a thorough understanding and comparison. But the job does not end there. A health insurance policy is a good deal only if you get your claim settled hassle-free. But the insurance company alone is not responsible for getting this done for you. There are a couple […]

Read More

Get a Health Insurance cover of 1 Cr at just Rs. 12K for Self , Spouse & 1 child.

There are a lot of new inventions in the health care sector with developments in science & technology. Robotic surgeries are soon going to be a common process of treatment in the future. It will be possible that the doctor or the specialists need not be physically present with the patient. There will be less […]

Read More

Don’t allow lockdown to lock your insurance cover as well

IRDA has given relaxation of 30 days in addition to the grace period of 30 days in the policy, for the payment of life insurance and health insurance premiums falling due during the lockdown time. So, your policy will not lapse. However, claims falling due after the expiry is not considerable till the payment of […]

Read More

Better alternatives for Optional Covers in Insurance Policies:

Better alternatives for optional coverage in insurance policies: Term Life Insurance-Return of Premium policies:The return received as a survival benefit is less when compared to the return under FD for the same term for the extra premium paid under this policy. PA is covered as a rider in various policies: It is good to buy […]

Read More

All about Lockdown and its impact on Insurance

The impact is not the same for all the lines of insurance. Life insurance is staring at huge claims due to the sudden and increased number of deaths, whereas the increased risk of falling sick has made people more aware of it. We will look in detail at the impact on commonly purchased lines of […]

Read More

Terms & conditions in Health Insurance Policy Should not be used for Marketing Tactics

When it’s a question of simply pooling the money for one who would actually incur a loss, then why are there so many terms and conditions? Why can’t it be as simple as that? In the case of hospitalization, the total bill amount up to the sum insured is payable? All I want to say […]

Read More

Health Insurance for Healthy people should cost zero

Nowadays health insurers are providing benefits to the insureds not only by bearing the medical expenses but also by adding options to the policy for their better health. Like a health coach Discount in the renewal premium for following any healthy habit and making a difference to their health. Especially in India, it’s difficult to […]

Read More

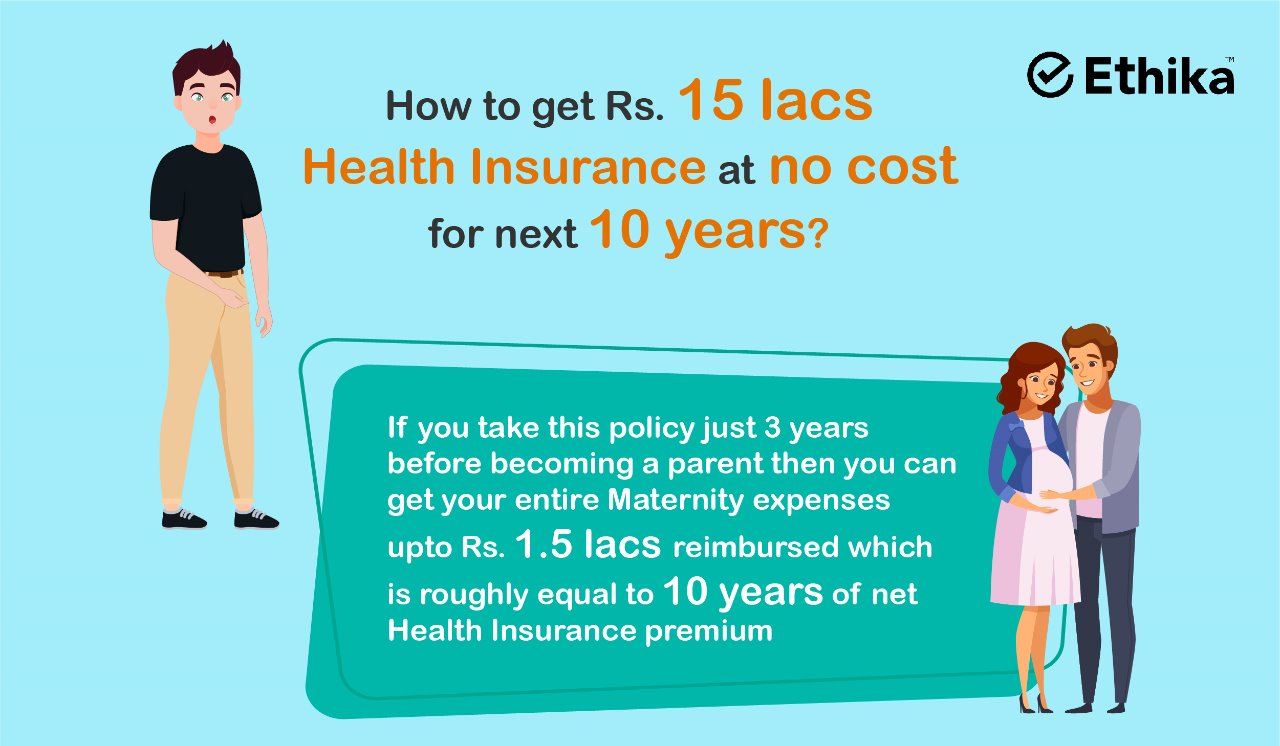

How to get your 15 lakh Health Insurance at no additional cost for the next 14 years?

Are you planning to get married? Are you prepared for the roles and responsibilities that come with it? Every milestone in your life brings more responsibilities. Manage them well with a beautifully designed health insurance policy that covers Maternity expenses up to Rs.1.5 lacs. If you take this policy just 3 years before becoming a […]

Read More

Covering Employees Parents under group health insurance- 3 different cases

Covering Employees’ Parents under group health insurance- 3 different cases The premium payable is decided based on many factors and the most important among those is the previous year’s claims. With people who are aged and with a pre-existing disease it is very natural that the frequency of claims will be high and most of […]

Read More

Framework for Structuring the Group Health Insurance Plan for your Employees

Framework for Structuring the Group Health Insurance Plan for your Employees Let’s see the basic point to consider when designing an efficient plan: Focus on preventive health checks: Healthy employees make for a healthy workplace. Timely health screenings of employees are important not just for the wellness of the employees but also for the growth […]

Read More

Determining the Sum Insured for Property Insurance

It is vital to understand the operation of an insurance contract in order to look into the aspect of determining the sum insured under the policy. A contract of insurance is defined as “a contract whereby one party, called the Insurer, in consideration of premium paid by another party, called the Insured, agrees to indemnify […]

Read More

How to Control the Claims in Group Health Insurance?

How to exercise claim control measures in group health insurance Group Health Insurance premiums in the Indian market are very competitive compared to the world market and have been driven more by prior year premiums than claims experience. As a result, organizations and employers have had a good ride, as they were able to pass […]

Read More

Why Do We Ignore Insurance in India?

Lack of awareness Indian culture is rich in a lot of things, but financial consciousness is not one of them. Children and young adults are educated in social do’s and don’ts, but not in matters of financial planning. All of us have seen examples around us when risk planning is discussed on the hind side. […]

Read More

Do You Really Need Insurance Broker for Group Health Insurance ?

Finding a well-planned and comprehensive Employee Benefits Program for the employees can be a real challenge and that’s why insurance helps in designing a well-structured benefits program so that the right people continue to work for an organization. Furthermore, the whole customer experience in group health insurance or group mediclaim is driven by a triad […]

Read More

Employee State Insurance Corporation

Employee state insurance corporation (ESIC) is a comprehensive insurance system that safeguards the employee in situations like disability, sickness, maternity, as well as in case of demise. All the benefits administered are in line with the international labor organization. ESIC administers the ESI (Employee state insurance). Recommended Post Benefits of ESI Scheme Who is covered […]

Read More

Insurance – Right place to Build your Career

The insurance industry is presently seeing many reforms. A recent amendment to the Insurance Act to increase the FDI to 74% has made this sector very lucrative. The whole world is looking at India as a minefield of insurance opportunities. The current market penetration in Insurance is only 3% which is half of other developing […]

Read More